Sources of Finance

The financing of your business is the most fundamental aspect of its management. Get the financing right and you will have a healthy business, positive cash flows and ultimately a profitable enterprise. The financing can happen at any stage of a business’s development. On commencement of your enterprise you will need finance to start up and, later on, finance to expand.

Finance can be obtained from many different sources. Some are more obvious and well-known than others. The following are just some of the means of finance that are open to you and with which we can help.

Bank loans and overdrafts

The first port of call that most people think about when trying to obtain finance is their own bank. Banks are very active in this market and seek out businesses to whom they can lend money. Of the two methods of giving you finance, the banks, especially in small and start-up situations, invariably prefer to give you an overdraft or extend your limit rather than make a formal loan. Overdrafts are a very flexible form of finance which, with a healthy income in your business, can be paid off more quickly than a formal loan. If, during the period you are financing the overdraft, an investment opportunity arises, then you could look to extend the options on your overdraft facility to finance the project.

Many businesses appreciate the advantages of a fixed term loan. They have the comforting knowledge that the regular payments to be made on the loan make cash flow forecasting and budgeting more certain. They also feel that, with a term loan, the bank is more committed to their business for the whole term of the loan. An overdraft can be called in but, unless you are failing to make payments on your loan, the banks cannot take the finance away from you.

Many smaller loans will not require any security but, if more substantial amounts of money are required, then the bank will certainly ask for some form of security. It is common for business owners to offer their own homes as security although more risk-averse borrowers may prefer not to do this. Anyone offering their house as security should consult with any co-owners so that they are fully aware of the situation and of any possible consequences. Another source of security may be the Enterprise Finance Guarantee Scheme. Start-up business unable to provide any other form of security may be able to get a guarantee for loans up to £1,000,000. Under the scheme, you pay a 2% premium on the outstanding balance of the loan, and in return, the government guarantees to repay the bank (or other lender) up to 75% of the loan if you default.

Savings and friends

When commencing a new business, very often the initial monies invested will come from the individual’s personal savings. The tendency of business start-ups to approach relatives and friends to help finance the venture is also a widespread practice. You should make it clear to them that they should only invest amounts they can afford to lose. Show them your business plan and give them time to think it over. If they decide to invest in your business, always put the terms of any agreement in writing.

Issue of shares

Another way of introducing funds to your corporate business is to issue more shares. This is always a welcome addition to business funds and is also helpful in giving additional strength to the company’s balance sheet. However, you need to consider where the finance is coming from to subscribe for the new shares. If the original proprietor of the business wishes to subscribe for these shares, then he or she may have to borrow money in a similar way to that discussed above. Typically, however, shareholders in this position are often at the limit of funds that they can borrow. Therefore, it may be necessary to have a third party buy those shares. This may mean a loss of either control or influence on how the business is run. An issue of shares in this situation can be a very difficult decision to make.

Venture capital

Approaching venture capital houses for finance will also mean an issue of new shares. The advantage of going to such institutions is the amount of capital they can introduce into the business. The British Private Equity and Venture Capital Association offers useful free publications (www.bvca.co.uk). Further information can be obtained from the British Business Angels Association (www.bbaa.org.uk). Because of the size of their investment, you can expect them to want a seat on your Board. They will also make available their business expertise which will also help to strengthen your business, although inevitably this will come with an additional pressure for growth and profits.

On a smaller scale, the government has introduced various tax-efficient schemes for entrepreneurs to invest in growing businesses. The current schemes available are called the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCT). We have separate factsheets providing detail in this area. They are similar schemes but complementary to one another. The former allows an individual to invest directly in your company and the latter allows an individual to invest in a fund which, in turn, will invest in a portfolio of venture capital investments. The investors will get 20% and 30% income tax relief respectively on any monies invested.

Another useful element of the EIS is that it allows any person with capital gains to defer these gains by investing into a company requiring venture capital. This deferral relief, unlike the income tax relief described above, which is subject to more stringent conditions, is available to controlling shareholders of such growing companies. If your company requires finance and you have a capital gain, we can advise on how to use the deferral relief effectively.

Retained earnings and drawings

Since ultimately the well-being of a business is connected with the cash flow of that enterprise, if a proprietor would like more liquidity, then it is sometimes necessary to re-examine the amount of money they are withdrawing from the business for their personal needs. In this way, additional funds earned by the business can be retained for future use.

Other finance

Other possible sources of finance are outlined below.

Factoring

Factoring provides you with finance against invoices that your customers have not yet paid. Typically you can receive up to 85% of the value of the invoice immediately and the balance (less costs) when the customer pays.

Hire Purchase (HP)

This is used to finance the purchase of equipment. Your business buys the equipment but payments of capital and interest are spread over an agreed period.

Leasing

This is a method of financing equipment you do not need to own. It is often used for vehicle finance. The equipment is rented rather than owned and the rental payments spread over several years. There can also be the option to fix maintenance costs as part of the agreement (contract hire).

Matching

It makes sense to match the finance you are seeking to the purpose for which it will be used.

| Working capital | – | overdraft or factoring |

| Equipment and vehicles | – | fixed-term loan, HP or leasing |

| Property | – | long-term mortgage |

| Development / start up | – | investment finance. |

How we can help

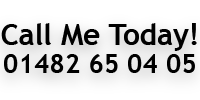

We have the expertise and the contacts to help you at all stages of your business development and to help you finance the business along the way. If you have any questions or proposals, we would be happy to discuss them with you.