Accounts and Tax Calendar

Dates to put in your schedule to make sure that you stay in the good books of HM Revenue and Customs (HMRC).

| Date | Event | Applies To |

| 31 January | Online filing of Self Assessment Tax Return deadline. | Individuals and partnerships. |

| 31 January | Balancing payment (previous year) and 1st Payment on Account for personal tax. | Individuals. |

| 31 March | End of corporate tax year. | Companies. |

| 5 April | End of financial tax year. | Individuals, partnership and companies. |

| 19 April | All outstanding PAYE and N.I. for the year ended 5th April to be paid, or be subject to HMRC interest. | All employers. |

| 19 May | Employer’s PAYE return form P35 for the year ended 5th April to be filed with the Inland Revenue. | All employers. |

| 31 May | Deadline for distribution of P60’s to all employees. Do not distribute to employees who left your employment within the tax year. | All employers. |

| 6 July | Deadline for filing P11Ds and P11D(b)s and for distributing P11Ds to employees. | All employers who offer benefits-in-kind e.g. company car. |

| 19 July | Payment deadline for Class1A National Insurance. | All employers who offer taxable benefits-in-kind e.g. company car. |

| 31 July | 2nd payment on account due for personal tax. | Individuals. |

| 31 October | Paper filing of tax return deadline. | Individuals and partnerships |

Useful dates and deadlines

| Date | Event | Applies To |

| 19th of each month | PAYE and NI for the previous month to be paid to the Inland Revenue. | All employers not on Quarterly Payment scheme. |

| 14 days after each calendar quarter and 14 days after company year-end | Form CT61 to be filed with the Inland Revenue if any interest paid with income tax deducted at source. | Companies only. |

| Quarterly (unless on special scheme) | VAT Return to be filed with HMRC, together with VAT due | All VAT registered businesses. |

| 3 months after commencing self-employment | Self-employment to be notified to Inland Revenue. | Individuals and partnerships. |

| 9 months and 1 day after company year-end | Corporation tax for the year to be paid. | Companies only. |

| 9/10 months after company year-end | Company accounts for the year to be filed with Companies House. | Companies only. |

| 12 months after company year-end | Deadline for filing corporation tax return form CT600 with HMRC. | Companies only. |

| Annually (Date of company incorparation unless changed) | Deadline for filing form 363a Annual return with Companies House. | Companies only. |

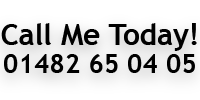

If you have any queries about the timing of submissions or filings for HMRC then simply call or email us and we will be delighted to help you out.

Why not use our FREE service where we will send you reminders before important dates?

To use this service, we will need your name, company name, company year end date, and VAT status. Sign up for ‘Tax Reminders’ on the contact form on the right.

(Disclaimer: The use of this service in no way reduces your responsibility as a business owner to meet HMRC requirements. A.D.Smith can not be held responsible for any late payment problems you may have with HMRC.)